Proven Strategies for Effectively Overcoming Debt Challenges During Furlough Periods

Proven Strategies for Effectively Overcoming Debt Challenges During Furlough Periods

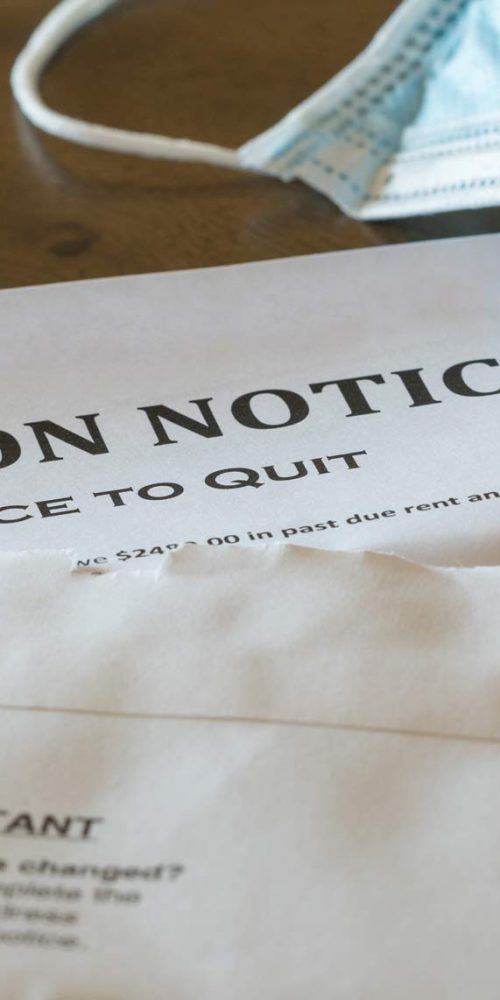

The COVID-19 pandemic has significantly impacted the UK economy, resulting in extensive furloughs and job losses across various industries. This economic downturn has led many individuals to face serious financial difficulties, particularly the daunting task of managing their debts amidst a drastic decline in income. If you find yourself furloughed for an extended period, dealing with your debts can become overwhelming, especially when you are only receiving 80% of your regular pay. However, it is entirely possible to navigate these financial challenges through effective planning and proactive financial management. Here’s how you can take charge of your financial well-being during these turbulent times and work towards a more secure financial future.

1. Create a Customized Monthly Budget That Reflects Your Current Financial Situation

Begin by developing a revised monthly budget that accurately represents your current financial status. This budget should factor in your reduced income and highlight your savings potential. Take the time to analyze your spending habits and consider reallocating funds from non-essential categories, such as entertainment, dining out, and luxury purchases, toward your necessary bills and savings. By prioritizing your financial commitments and cutting back on discretionary spending, you can create a sustainable budget that enables you to effectively manage your debt while also preparing for any potential future financial challenges that may arise.

2. Seek Additional Income Sources to Offset the 20% Reduction in Pay

To uphold your commitment to repaying debts, it is crucial to find ways to compensate for the 20% salary decrease. Explore alternative income options, such as freelance projects, gig economy opportunities, or part-time jobs, while also considering ways to cut expenses by canceling seldom-used subscriptions and reevaluating your grocery shopping strategies. Implementing a budget-friendly meal plan can greatly reduce your monthly expenses. By actively pursuing these savings opportunities and diversifying your income streams, you will be in a stronger position to fulfill your debt obligations and avoid falling behind during your furlough period.

3. Investigate Debt Consolidation Loans to Streamline Your Payment Process

Consider applying for debt consolidation loans for bad credit. These financial solutions can simplify your repayment process by consolidating multiple debts into a single, manageable monthly payment. This approach can help reduce the confusion surrounding various due dates and payment amounts, making financial planning easier to navigate. For those on furlough, a <a href=”https://limitsofstrategy.com/debt-consolidation-loan-calculator-for-effective-budgeting/”>debt consolidation loan</a> can offer a structured way to manage limited income while alleviating the stress associated with juggling multiple payments, ultimately helping you regain financial stability.

4. Formulate a Plan for Your Long-Term Financial Aspirations and Security

As you work through your current financial challenges, take the opportunity to reflect on your long-term goals, such as buying a home or starting a business. Establishing these future objectives can act as a powerful motivator in enhancing your financial situation. Additionally, a debt consolidation loan can improve your credit score over time, potentially increasing your chances of qualifying for a mortgage or business loan with better terms. By planning strategically and focusing on your financial aspirations, you can create a roadmap to success and achieve greater financial independence in the long run.

For more guidance and expert advice on effectively managing your finances during these challenging times, and to understand how <a href="https://limitsofstrategy.com/understanding-good-debt-and-bad-debt-a-clear-guide/">debt consolidation loans</a> can benefit furloughed employees, feel free to reach out to Debt Consolidation Loans today.

If you own a home or run a business, connect with the experts at Debt Consolidation Loans today to explore how a debt consolidation loan can improve your financial health and overall stability.

If a Debt Consolidation Loan aligns with your financial objectives, don't hesitate to contact us or call 0333 577 5626. Take the crucial first step toward enhancing your financial situation with a single, manageable monthly payment.

Unlock Valuable Financial Resources for Expert Guidance and Support:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Can You Effectively Consolidate Your Medical Loan? Explore Your Options

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March: Key Information You Need to Know

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Proven Strategies for Quickly Escaping Debt

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Examining the Advantages and Disadvantages of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning

Enhance Your Financial Planning with Our Comprehensive Debt Consolidation Loan Calculator

The Article Furloughed and in Debt? Key Actions You Must Take Was Found On https://limitsofstrategy.com

The Article Furloughed

Comments are closed